Stocks Open Higher as Hopes for Fed's Pause in Hikes Grow: Stock Market Update

Stocks edge higher as hopes for a Fed pause rise. Wall Street cautiously optimistic amid Middle East tensions. Stay updated with the latest market trends.

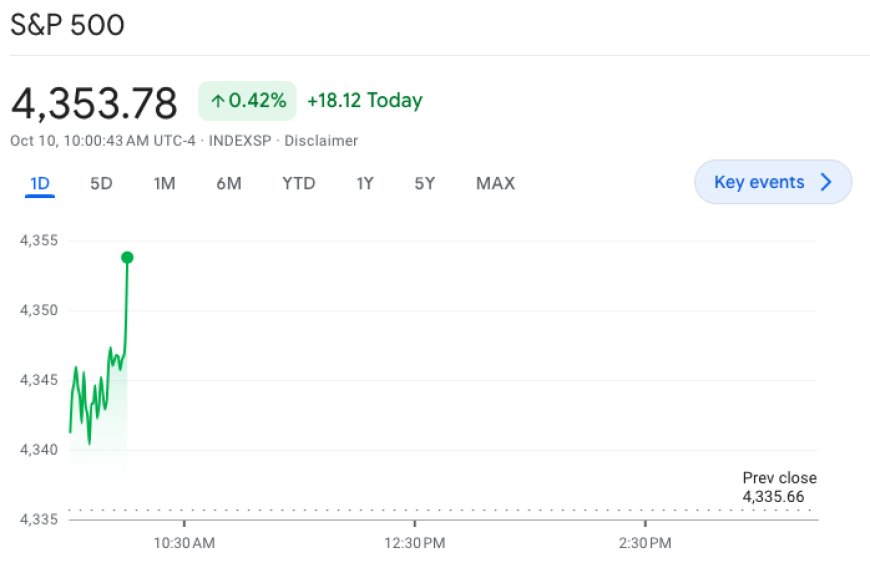

On Tuesday, Wall Street saw modest gains, driven by optimism that the Federal Reserve may halt interest-rate hikes. The Dow Jones Industrial Average gained nearly 0.3%, the S&P 500 rose around 0.2%, and the Nasdaq Composite added roughly 0.2%. This follows a reversal of losses on Monday.

This positive trend came after dovish remarks from two Fed officials, suggesting that the recent surge in bond yields might prompt a tightening in credit conditions, potentially leading to a pause in rate hikes for this cycle.

While the IMF emphasized the need for tight monetary policy in most regions, it also noted that central banks still have work to do in bringing inflation down to target levels.

Yields on Treasuries eased as trading resumed after a holiday, with the 10-year Treasury yield dropping from its 16-year peak. Meanwhile, oil prices receded after a previous 4% surge driven by concerns over potential supply disruptions from the Middle East conflict.

In the corporate sphere, PepsiCo shares rose by 1.4% following robust third-quarter earnings and an upgraded annual earnings forecast.

Throughout the day, investors will pay close attention to several Fed officials, including Raphael Bostic, Neel Kashkari, Christopher Waller, and Mary Daly, as they address the markets.

Stock Futures Edge Up as Hopes for Fed Pause Gain Traction

As trading kicks off on Tuesday, stock futures indicate a positive start. Futures for the Dow Jones Industrial Average are up 0.17% (58 points), S&P 500 futures have risen 0.11%, and Nasdaq 100 contracts are showing a 0.12% increase. This comes as investors closely monitor dovish signals from Federal Reserve officials while keeping an eye on developments in the Middle East conflict.

Leading Pre-market Trending Stocks:

-

PepsiCo (PEP): Shares are up 1% premarket, as the company surpasses Wall Street estimates in its third-quarter earnings release.

-

Arm (ARM): The chipmaker's shares show nearly a 2% rise premarket on Tuesday. Analysts from Guggenheim, Citi, and JPMorgan have initiated coverage on the semiconductor company, all giving it a bullish rating.

-

Rivian (RIVN): Rivian shares have risen over 2% after a UBS upgrade, despite Wedbush lowering its price target for the EV maker.

-

Unity Software (U): Shares are up 4%. The group has appointed technology veteran James Whitehurst as interim CEO, replacing John Riccitiello, who is retiring.

Also Read: Wall Street Prepares for Subdued Start Amid Escalating Middle East Tensions