Apple Stock Facing 10% Correction Amid Growth Concerns

Apple's stock decline raises growth concerns. Sluggish August performance prompts questions about future prospects. Insights on AAPL's challenges and outlook.

Apple (AAPL) investors have faced a challenging August as renewed growth concerns trigger a decline in the tech giant's stock. The downward trend in Apple's shares, attributed to a variety of factors, prompts scrutiny over the company's short-term prospects.

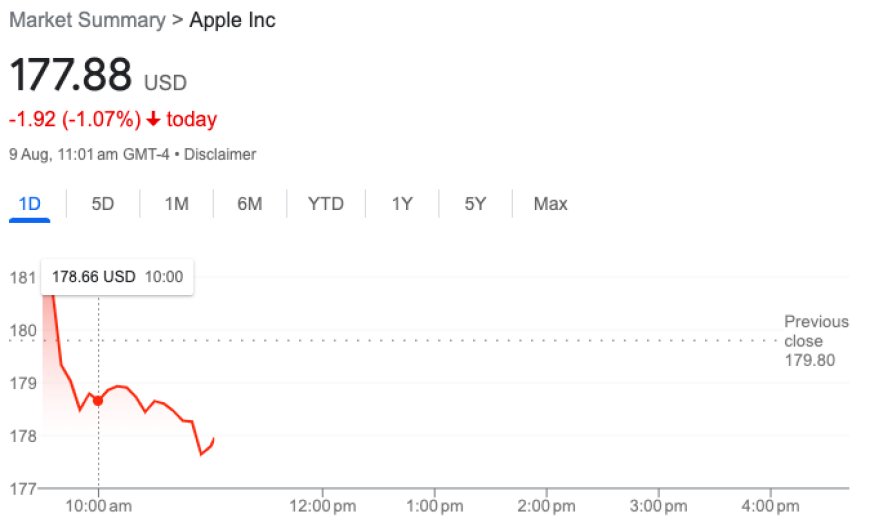

In the latest market update, Apple's stock has experienced a notable setback, declining by approximately 8.8% during August, as reported by Yahoo Finance data. This performance significantly lags behind the broader market benchmark, the S&P 500, which saw a comparatively modest 1.6% drop. Amidst this downward shift, Apple's stock has dipped below its crucial 50-day moving average, a technical indicator of market sentiment.

When juxtaposed with its peak on July 31, the decline in Apple's stock value is around 9%. This puts the company on the brink of fulfilling the criteria for a market correction, standing just one percentage point away. Over this period, Apple's market capitalization has experienced a substantial contraction, losing an estimated $255 billion.

Prominent Apple advocate and Wedbush tech analyst, Dan Ives, offered insights into the market dynamics, stating, "The move is just knee-jerk August selling after a parabolic run so far this year." He underlined that selling Apple shares now, particularly with the imminent iPhone 15 launch, along with strong services growth and a broader tech market rally, would be akin to exiting the Super Bowl at halftime.

Despite the current challenges, Apple's year-to-date performance remains robust, showcasing an impressive 38% gain. This underscores its relative strength compared to the broader market, which has yielded a 17% gain within the same timeframe.

Yet, the factors behind Apple's recent pullback extend beyond mere profit-taking. Market sentiment suggests that concerns about sluggish economic conditions in both the US and China could cast a shadow over Apple's future performance, potentially extending into 2024.

Apple's latest earnings report further fueled these apprehensions. Notably, sales of key products like iPhones, Macs, and iPads experienced a decline in the most recent quarter. This decline was observed across multiple geographic segments including the Americas, Japan, and Rest of Asia.

JPMorgan analyst, Samik Chatterjee, highlighted this trend, pointing out, "The geographic performance continues to highlight the challenges in key developed markets."

The company's guidance for the September quarter, which indicated a modest year-over-year revenue decline, came as a surprise to the market. This contrasted with market expectations of slight growth during the quarter.

Apple's CEO, Tim Cook, acknowledged the prevailing economic uncertainty, stating, "We continued to face an uneven macroeconomic environment."

Analyzing the situation, Amit Daryanani, an analyst at Evercore ISI, noted that investors may start to question Apple's short-term growth prospects due to Cook's remarks and the company's formal guidance.

Since the earnings release, the economic outlook has become increasingly uncertain. The recent July jobs report revealed a slowdown in employment growth, accompanied by significant revisions to past months. Meanwhile, China, a pivotal market for Apple, experienced deflation, compounded by discouraging trade data.

In light of these developments, a prevailing sentiment suggests that a subdued global economy could pose challenges for Apple, especially as the company prepares to launch key products such as the iPhone 15 and Vision Pro.

Dan Ives concluded, "While bears may have secured a minor victory last week, their bearish stance on Cupertino seems to be losing traction in the larger context."

Also Read: iPhone 15 Preview: What to Expect from Apple's Next-Generation Flagship