Markets Anticipate Federal Reserve Decision: Stocks on the Rise

Investors Optimistic as Fed Meeting Concludes with Expectations of Steady Interest Rates

Market indices show positive movement as anticipation builds for the Federal Reserve's announcement on interest rates at the end of their meeting. Traders predict a 99% likelihood of rate stability, focusing on future projections and insights from Fed Chair Jerome Powell.

Market Opening Performance

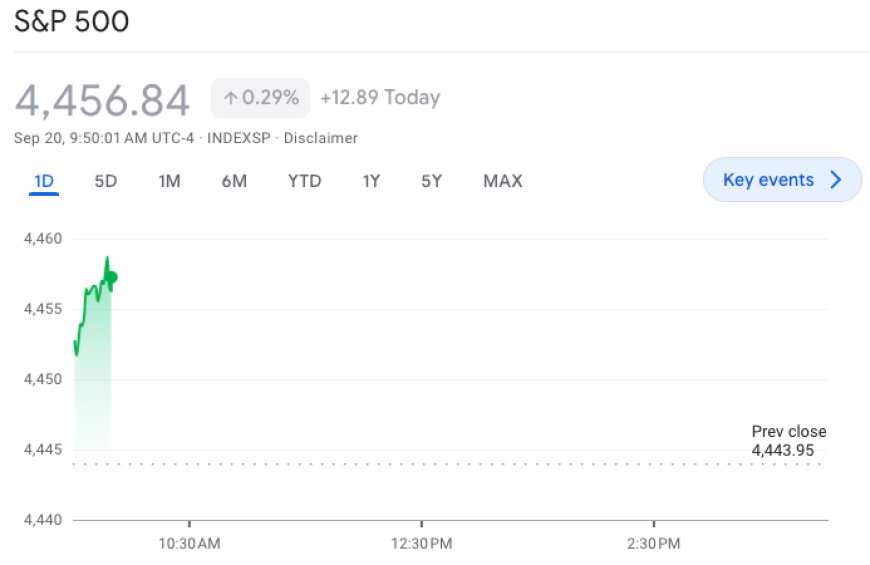

At the opening bell, both the Dow Jones Industrial Average (^DJI) and the S&P 500 (^GSPC) surged by approximately 0.2%. This rebound follows a marginal decline in benchmarks from the previous session. The tech-centric Nasdaq Composite (^IXIC) also saw an uptick of around 0.1%, recovering from a dip attributed to Instacart's IPO activity.

The Fed's Stance

Market sentiment strongly leans towards the belief that the Federal Reserve will maintain current interest rates, with a 99% probability of a pause in tightening measures according to the CME FedWatch Tool. Attention shifts towards future prospects: whether there will be further adjustments later in the year, and the potential for a rate cut.

Decoding the "Dot Plot"

All eyes are on the central bank's "dot plot," providing projections for the future trajectory of interest rates. Additionally, investors await cues from Fed Chair Jerome Powell's comments for insights into the Fed's future plans.

Oil Prices' Influence

The recent surge in oil prices, viewed by some as a challenge to the Fed's anti-inflation efforts, saw a slight retreat on Wednesday. Investors are contemplating how the policy decision might impact economic growth and fuel demand. Both Brent crude (BZ=F) and WTI crude (CL=F) futures experienced a dip of about 0.7%. However, concerns linger that prices might be headed towards the $100 mark.

Resilient IPO Market

Klaviyo (KVYO) is set to make its debut on Wednesday, joining the recent successful entries of Arm (ARM) and Instacart. The marketing automation company has priced its offering above range at $30 per share, resulting in a valuation of $9.2 billion.

UK Inflation's Impact

An unexpected slowdown in UK inflation has increased the likelihood of the Bank of England pausing its rate hikes after a final increase expected on Thursday. The British pound faced a drop following the August inflation report.

Pre-market Trends

Here are some of the stocks leading Yahoo Finance’s trending tickers page in premarket trading on Wednesday:

-

Instacart (Maplebear Inc.) (CART): Shares for the grocery delivery business were down by 4%. On Tuesday, Instacart went public on the Nasdaq. Its stock opened around $42 a share, some 40% higher than the anticipated $30, but pared gains before ending up about 12%.

-

Pinterest (PINS): The image-sharing and social media service saw its share price rise by 4%. On Tuesday, it announced the appointment of Scott Schenkel, former chief financial officer and interim CEO of eBay, to its board.

-

General Mills (GIS): Shares in Cheerios maker General Mills rose by 1% after it topped quarterly sales as price hikes on its products helped cushion a slowdown in demand.

-

Dollar General (DG): Shares fell by 1%. A report from Bloomberg on Wednesday documented poor working conditions at the retailer's stores.

Futures Outlook

Stock futures on Wall Street are indicating a higher open ahead of the Federal Reserve policy decision. Traders are confident that policymakers will keep interest rates steady. Futures tied to the Dow Jones Industrial Average (^DJI) were up 0.20%, or 68 points, while S&P 500 (^GSPC) futures advanced 0.17%. Nasdaq 100 futures moved up 0.13%.

Also Read: Stock Market News Today: Federal Reserve Meeting & Instacart's Nasdaq Debut