Stock Market News Today: Federal Reserve Meeting & Instacart's Nasdaq Debut

Stay informed about the Federal Reserve's policy meeting and Instacart's high-profile entry on the Nasdaq. Get the latest updates on interest rates, IPO market, and more.

The US stock market eagerly anticipates the Federal Reserve's latest policy meeting while keeping a watchful eye on the impending debut of Instacart on the Nasdaq.

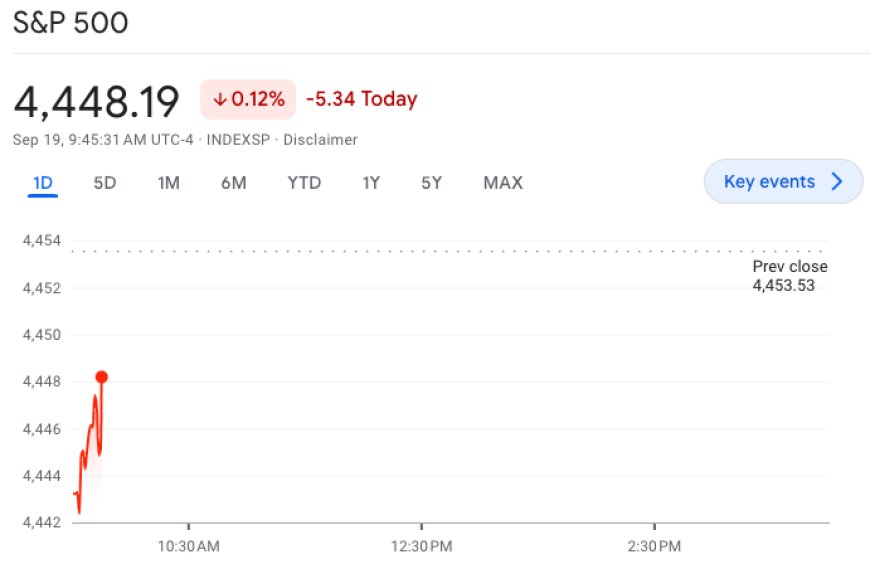

Early Tuesday saw both the S&P 500 (^GSPC) and the Dow Jones Industrial Average (^DJI) experiencing a slight downturn of about 0.2%. Meanwhile, the Nasdaq Composite (^IXIC) registered a slightly more pronounced decline, edging over 0.4%.

As the Federal Open Market Committee convenes, all eyes are on the Fed's approach to interest rates in light of their ongoing battle against inflation. With a 99% probability, according to the CME FedWatch Tool, that rates will remain stable, investors are particularly interested in the commentary of Fed Chair Jerome Powell regarding the November meeting. They also await any fresh insights provided in the updated Summary of Economic Projections, often referred to as the "dot plot."

David Mericle, Chief US Economist at Goldman Sachs, offered a glimpse into the anticipated meeting. He noted that Fed officials have signaled a cautious approach, likely maintaining the funds rate in the range of 5.25-5.5% throughout September. The immediate focus for markets is whether the median dot will continue to project an additional hike this year, reaching 5.5-5.75%, possibly in November. Mericle believes it will, albeit by a narrow margin, partly driven by strategic considerations aimed at maintaining flexibility.

Meanwhile, all eyes are on Instacart, poised to make its debut on the Nasdaq under the ticker CART. The company has set an IPO price of $30 per share, valuing it at approximately $10 billion. This high-profile entry into the public market is closely watched by experts who believe it could signal the trajectory of the broader IPO market.

Additionally, the market is buzzing with rising oil prices, especially with gas prices hitting a peak for 2023 on Monday. West Texas Intermediate (CL=F) saw an early trade increase of over 1% on Tuesday, surging above $92 per barrel. Brent crude (BZ=F) experienced a modest uptick of just over 0.5%, reaching $95 per barrel.

In other news, the United Auto Workers strike continues into Tuesday. The UAW has indicated plans to extend the strike to more Stellantis (STLA), GM (GM), and Ford (F) plants if no progress is made in contract negotiations by Friday.

Stay tuned for more updates as these events unfold in the dynamic landscape of the stock market.

Also Read: Instacart Gears Up for Nasdaq Debut Following Arm's High-Profile Entry