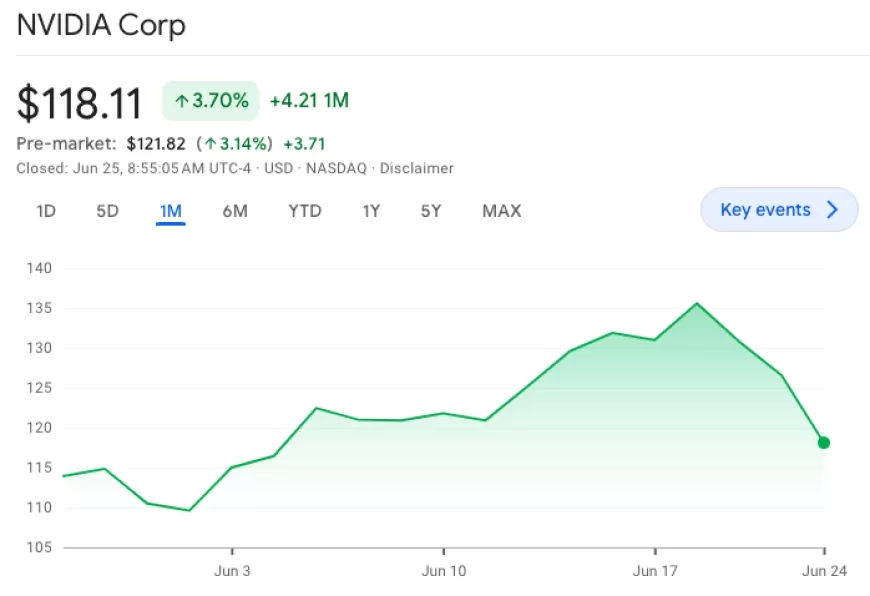

Stock Market Live Updates: Nasdaq Gains as Nvidia Rebounds: Market Update and Key Economic Data Insights

Nasdaq rises as Nvidia rebounds. Get the latest stock market updates, key economic data, and insights on shifts from tech to value stocks

US stock futures remained stable on Tuesday, with Nvidia (NVDA) leading a cautious recovery after a three-day decline. Investors are adjusting their portfolios as the quarter nears its end.

Market Movements:

-

Nasdaq 100 futures (NQ=F) increased by approximately 0.5%.

-

S&P 500 futures (ES=F) rose by 0.2%.

-

Dow Jones Industrial Average futures (YM=F) decreased by 0.1% after gaining over 200 points at the start of the week.

Stocks are showing signs of improvement following recent downturns in the Nasdaq and S&P 500, which were affected by Nvidia's slump. Investors seem to be taking profits from AI-related stocks as the strong quarter concludes, raising questions about potential further losses.

Nvidia shares rose over 2% in premarket trading, rebounding from a more than 6% drop on Monday.

Shift in Market Focus: The Dow is finding stability as the focus shifts from tech to value stocks, suggesting that gains may extend to other sectors.

Upcoming Economic Data: Investors await Friday's update on the Personal Consumption Expenditures (PCE) index, a key inflation measure for the Federal Reserve. Governor Michelle Bowman indicated she is prepared to raise interest rates if necessary to control inflation.

Other important data include:

-

Case-Shiller's report on April home prices.

-

A consumer confidence reading, which investors will watch closely for signs of weakening resilience.

Also Read: Stock Market Live Updates: Stocks Edge Up As Wall Street Aims to Close Q2 On a High Note

Key Moments

- Nasdaq 100 futures rise 0.5% as Nvidia rebounds.

- S&P 500 futures up 0.2% amid market stability.

- Dow Jones futures dip 0.1% after early week gains.

- Investors await key PCE index update for inflation insights.

-

Understanding Nvidia's Recent Market Performance

As discussions swirl about Nvidia's (NVDA) recent decline, it's helpful to review some key data, thanks to BTIG’s technical analyst Jonathan Krinsky. These figures shed light on why Nvidia's shares have slowed down.

Krinsky points out, "NVDA recently traded about 100% above its 200-day moving average. Since 1990, the largest gap any U.S. company has seen above this average, while being the biggest company, was 80% by Cisco (CSCO) in March 2000, which was its all-time high. This shows how exceptional NVDA's position is."

Interestingly, last week, Nvidia briefly overtook Microsoft (MSFT) as the largest U.S. company. A similar event happened on March 24, 2000, when Cisco surpassed Microsoft, marking a peak for both Cisco and the Nasdaq.

Krinsky also compares the gains: "In the past five years, NVDA has grown 4,280%, while Cisco had a 4,460% increase in the five years before its peak. In the last 18 months, NVDA is up 827%, which is double Cisco's gain in the same period leading to 2000."

This perspective helps us understand that stocks don't continuously climb and highlights Nvidia's remarkable market performance.

-

Key Market Risk for 2025: The Expiration of Trump Tax Cuts

As if there weren’t already enough financial concerns, a significant risk looms on the horizon: the expiration of the Trump tax cuts in 2025.

US Treasury Secretary Janet Yellen has recently highlighted the potential impact of these tax cuts ending, a concern that has not been widely discussed among investors.

Yellen pointed out, "The Tax Cut and Jobs Act from the Trump era aimed to boost investments, but that boom never materialized. The policy provided substantial tax breaks to corporations and wealthy individuals, resulting in a significant increase in the deficit and a drop in tax revenues below historic levels. This has contributed to our current fiscal challenges, and leaving these cuts in place concerns me."

The market's reaction in 2025, should these tax cuts not be extended due to deficit concerns, remains uncertain. However, this potential change should not be ignored in investment planning. For instance, without an extension, the top tax rate would increase from 37% to 39.6%

-

U.S. Home Prices Reach New High in April, Growth Slows

U.S. home prices hit a new record high in April amidst a tight market, although annual growth moderated compared to previous months.

According to S&P CoreLogic Case-Shiller, home prices in the largest 20 U.S. metros rose by 7.2% over the past 12 months ending in April, slightly lower than the 7.5% gain recorded the previous month. Monthly data shows a 0.4% increase in April compared to March across these cities.

Factors such as low inventory, high mortgage rates, and record-high home prices continue to challenge prospective buyers, making homeownership increasingly unattainable. Economists at Bank of America caution that these housing market hurdles are likely to persist.

Bank of America economist Michael Gapen noted, “The U.S. housing market is currently stagnant, and we foresee these conditions enduring. Affordability issues and reduced housing activity, which were exacerbated during the pandemic, are expected to linger.”

The investment bank predicts home prices will rise by approximately 4.5% this year and 5.0% next year, with a projected decline to 0.5% in 2026 as residual effects from pandemic-related housing dynamics continue to play out.

-

Nasdaq Rises, Dow Falls as US Markets Open Mixed

US stocks showed mixed performance on Tuesday. Nvidia (NVDA), an AI chipmaker, started to recover from a recent three-day slump, gaining over 0.2% in early trading.

The Nasdaq Composite (^IXIC) rose by about 0.5%, and the S&P 500 (^GSPC) increased by 0.2%. In contrast, the Dow Jones Industrial Average (^DJI) dropped by around 0.2%, following a strong start earlier in the week where it gained over 200 points.

-

Consumer Confidence Dips Slightly in June, Halting Rebound Hopes

Consumer confidence experienced a minor drop in June, stalling previous signs of recovery. The Conference Board's index fell to 100 from 101.3 in May, aligning with economists' predictions.

Dana M. Peterson, chief economist at The Conference Board, explained, "Although confidence decreased in June, it stayed within the same range we've seen over the past two years. Positive views on the job market are still stronger than future concerns. If the job market weakens, confidence may drop further as the year progresses."

Peterson added, "This month, consumers had mixed feelings: they felt more positive about the job market but less optimistic about current business conditions."

-

Bitcoin Climbs Back Above $60K After Recent Dip

Bitcoin (BTC-USD) has bounced back, climbing above $60,000 after dropping to its lowest level since early May on Monday.

By late Tuesday morning, Bitcoin's price had risen by about 1%, trading at over $61,650 per coin. This positive trend also influenced other cryptocurrencies, with Ethereum (ETH-USD) seeing a price increase as well.

Although Bitcoin has dropped about 12% over the past three months, it is still up more than 45% this year, supported by the SEC's recent approval of SPOT bitcoin ETFs.