OpenAI Takes Steps to Block Elon Musk’s Takeover Attempts

OpenAI is making changes to prevent Elon Musk or any investor from taking over, ensuring its nonprofit board stays in control.

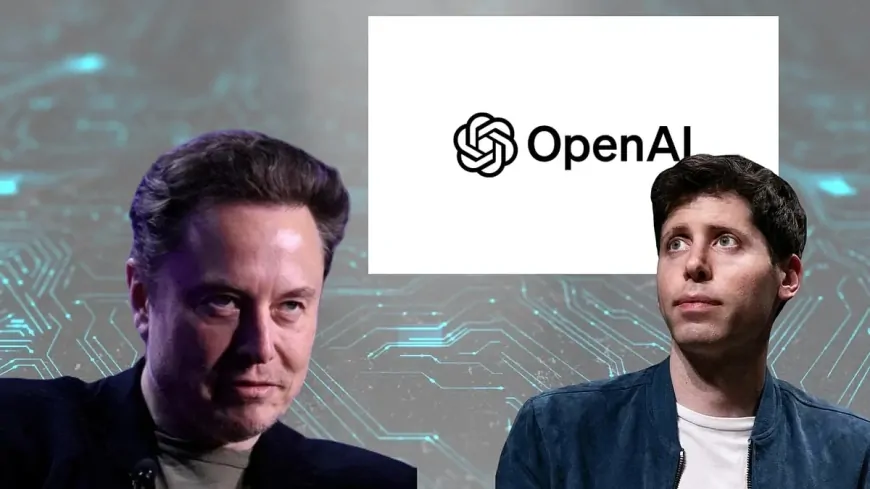

OpenAI is working to safeguard itself against potential takeover attempts, particularly from billionaire entrepreneur Elon Musk. Recently, Musk made an unsolicited bid to gain control of OpenAI, but the move was rejected by CEO Sam Altman and the company’s nonprofit board.

To prevent similar situations in the future, OpenAI is considering structural changes that would grant its nonprofit board members special voting rights. According to reports, these changes would allow the board to maintain authority over OpenAI even as it transitions into a for-profit public benefit corporation. By consolidating power within the nonprofit entity, OpenAI aims to counter Musk’s argument that it has deviated from its original mission and protect itself from other major investors like Microsoft and SoftBank.

This effort comes as OpenAI’s leadership faces legal challenges from Musk, who has filed a lawsuit attempting to block the company’s shift to a for-profit structure. Nonprofit law experts suggest that such protective measures require careful legal design to be effective. Since nonprofit organizations lack shareholders or traditional ownership, governance strategies become crucial in preventing hostile takeovers.

Legal scholars believe OpenAI might introduce a special class of voting stock in the restructured for-profit arm, ensuring that board members retain control over major decisions. This would enable them to override any potential takeover attempts, including those from influential investors like Microsoft, OpenAI’s largest financial backer.

Currently, Microsoft holds a profit-sharing interest in OpenAI rather than an equity stake. The tech giant is entitled to 75% of OpenAI’s profits until it recoups its $13 billion investment, after which it will receive 50% of profits until reaching a $92 billion cap. OpenAI’s transition to a public benefit corporation could open doors for new investors while restructuring existing profit arrangements.

Experts speculate that OpenAI’s board might implement a “poison pill” strategy, allowing them and aligned shareholders to acquire additional shares at a discounted rate in response to external takeover attempts. While this could deter unwanted bids, OpenAI’s board remains legally obligated to consider acquisition offers aligned with its mission to ensure artificial intelligence benefits humanity.

Musk’s attempted takeover, reportedly valued at $97.4 billion, fell well below OpenAI’s estimated worth, which is projected to reach as high as $300 billion following SoftBank’s potential $40 billion investment. Despite this, Musk continues to argue that OpenAI’s transition to a for-profit model violates the original nonprofit agreement under which he initially contributed $45 million in funding.

Altman publicly rejected Musk’s offer on social media, even humorously suggesting that OpenAI would be willing to purchase X (formerly Twitter) for $9.74 billion instead. OpenAI has also dismissed Musk’s lawsuit, arguing that his attempt to acquire the company contradicts his legal claims that its assets should not be used for profit.

On February 14, OpenAI’s board officially rejected Musk’s bid, reaffirming that the company is not for sale. Chairman Bret Taylor issued a statement emphasizing that the board unanimously opposed Musk’s latest effort, calling it an attempt to undermine his competition.

Also Read: Sam Altman Rejects Elon Musk’s $97.4B OpenAI Offer with a Sharp-Witted Response