Stock Market Update: Markets Show Signs of Recovery After Fed's Signal

Despite initial setbacks, the stock market shows signs of resilience after the Fed's hawkish signals. Get the latest updates on market trends and economic activities.

Wall Street started the day with a slight uptick, yet remains on track for weekly losses following a sell-off driven by the Federal Reserve's indication of prolonged high-interest rates.

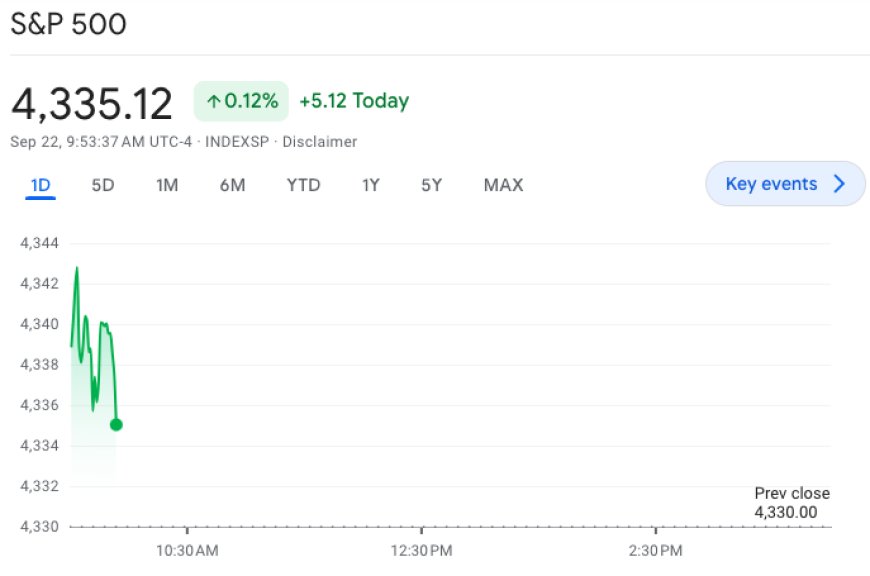

At the opening bell, the S&P 500 (^GSPC) saw a modest increase of around 0.2%, while the Dow Jones Industrial Average (^DJI) held steady. The Nasdaq Composite (^IXIC) showed a more notable rise of approximately 0.5%, attempting to recover from the previous session's significant downturn.

Investor sentiment turned cautious as they evaluated the potential impact on consumer and business demand due to the Fed's commitment to maintaining higher borrowing costs to curb inflation. Jerome Powell, the central bank's chair, provided little assurance regarding the avoidance of an economic recession.

Stocks now seem to be stabilizing, with the S&P 500 set for a rebound after experiencing its most challenging day since March. Meanwhile, the 10-year Treasury yield steadied after reaching its highest level in over 15 years on Thursday.

Later updates on September's US manufacturing and services activity from S&P Global are expected to fuel the ongoing debate about whether the Fed can achieve a "soft landing" for the economy.

Turning to global central banks, the Bank of Japan opted to retain its ultra-low interest rates on Friday, reaffirming its commitment to supporting the economy. This suggests no imminent shift in its extensive stimulus program. Consequently, the yen weakened against the dollar following the decision.

In the realm of individual stocks, Activision Blizzard (ATVI) saw an uptick in shares, closing in on Microsoft's (MSFT) offer price. This follows an announcement by the UK antitrust regulator that the door is open for the $69 billion acquisition to proceed.

Additionally, attention remains on the strikes impacting both the auto sector and Hollywood. The UAW has threatened to escalate walkouts in its ongoing strike against GM (GM), Ford (F), and Jeep parent Stellantis (STLA), with Friday as the deadline. Despite extensive negotiations, the four major studios — Warner Bros. Discovery (WBD), Disney (DIS), Netflix (NFLX), and NBCUniversal — failed to reach an agreement with the striking writers.

Stock Futures at a Glance:

-

Dow Jones Industrial Average (^DJI) futures: +0.12% (42 points)

-

S&P 500 (^GSPC) futures: +0.27%

-

Nasdaq 100 futures: -0.49%

Mixed Opening for Stocks as Wall Street Faces Weekly Losses

On Friday morning, investors navigated stocks in opposing directions as major indexes were on track for weekly losses. This trend comes as Wall Street contends with the Federal Reserve's measures to maintain higher interest rates for an extended period.

The S&P 500 (^GSPC) saw a marginal increase of 0.1%, whereas the Dow Jones Industrial Average (^DJI) experienced a slight dip of 0.1%, equivalent to 56 points. Meanwhile, the technology-focused Nasdaq Composite (^IXIC) witnessed a rise of approximately 0.5%.

This story is evolving. Stay tuned for more updates and information on the stock market...

Also Read: Instacart Stock Faces Volatility Post-IPO