Stock Market Update: S&P 500 and Nasdaq Gain After Fed Decision, Meta Shares Surge

US stocks rise with S&P 500 and Nasdaq up. Meta's strong earnings boost markets. Investors await Apple and Amazon results after Fed hints at rate cut.

US stocks continued their upward trend on Thursday, driven by strong earnings from Meta (META) and optimism for a potential rate cut from the Federal Reserve in September.

The S&P 500 (^GSPC) climbed 0.4%, while the Nasdaq Composite (^IXIC) also increased by about 0.4%. The Dow Jones Industrial Average (YM=F) saw a modest rise of around 0.1%.

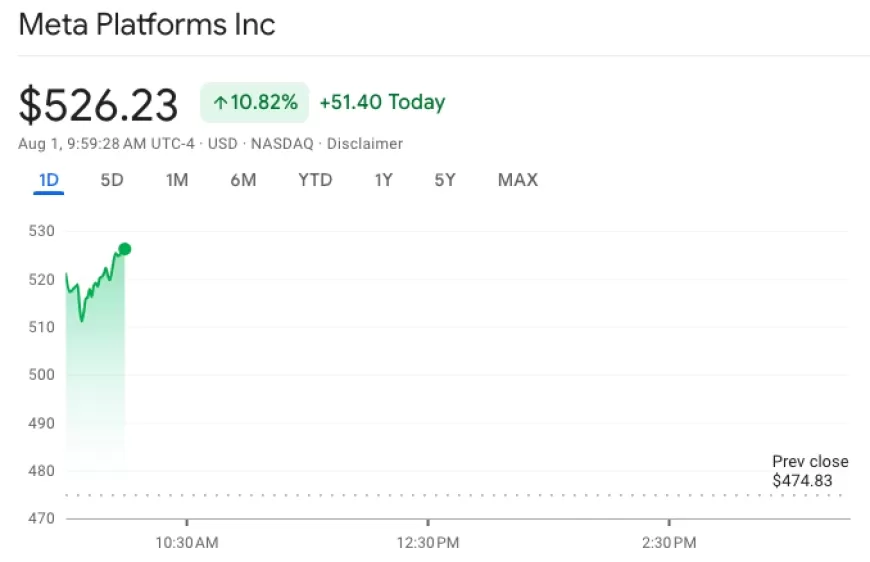

Investor sentiment improved after Fed Chair Jerome Powell hinted that a rate cut in September is a possibility, stating it "could be on the table." Most traders are anticipating a 25-basis-point reduction, although some are now considering a 50-basis-point cut following the Fed's decision to hold rates steady. The spotlight has shifted to quarterly earnings reports, particularly from major tech companies. Meta's impressive performance on Wednesday led to an over 8% surge in its shares, as the company reported strong earnings and robust digital ad revenue, which is expected to support its AI investments.

Also Read: Reddit Stock Price Target Raised by Analysts Before Earnings Report

Upcoming earnings reports from Apple (AAPL) and Amazon (AMZN) later in the day will be crucial in sustaining the positive momentum in tech stocks. These reports will also indicate whether the anticipated benefits from AI investments will materialize, especially after some disappointing earnings from other leading tech companies.

Additionally, weekly jobless claims data released on Thursday showed an increase to an 11-month high, setting the stage for the July jobs report expected on Friday. This report is closely watched for signs of a cooling labor market, which is a key factor in the Fed's policy decisions.

Key Moments

- US stocks rise with S&P 500 and Nasdaq up 0.4%.

- Meta shares surge over 8% after strong earnings report.

- Federal Reserve hints at potential September interest-rate cut.

- Apple and Amazon earnings results expected later today.

-

Jobless Claims Surge Past Expectations: Labor Market Shows Signs of Cooling

Last week, jobless claims unexpectedly increased, signaling a potential shift in the labor market. According to the Department of Labor, there were 249,000 new jobless claims for the week ending July 27, up from 235,000 the previous week and exceeding economists' forecasts of 235,000. This is the highest weekly total since August 2023. Additionally, continuing unemployment claims reached 1.877 million for the week ending July 20, up from 1.84 million the week before and the highest since November 2021.

Economist Thomas Simons from Jefferies commented, "The recent rise in claims indicates a slight cooling in the labor market, although it's still relatively strong. This change is part of the labor market's adjustment process, but we need to be cautious about potential further declines. If the trend continues, it could quickly impact the broader job market."

-

Stocks Up as Fed Hints at September Rate Cut, Meta Soars 10%

Stocks began Thursday's trading session on a positive note, building on the previous day's gains, spurred by the Federal Reserve's indication of a potential rate cut in September. The S&P 500 advanced by 0.4%, while the Nasdaq Composite rose by nearly 0.5%. The Dow Jones Industrial Average increased by 0.4%.

The boost in the stock market followed Fed Chair Jerome Powell’s comments that suggested a rate cut could be on the horizon for September. Meta’s stock saw a notable jump of around 8% after the tech giant reported stronger-than-expected quarterly earnings and outlined its plans for significant investments in artificial intelligence infrastructure for 2025.

-

US Manufacturing Sector Declines Further in July

The US manufacturing industry worsened in July, showing a deeper contraction. The ISM's manufacturing index dropped to 46.8, down from 48.5 in June and below the 48.5 that experts had forecasted. This is the lowest level since November 2023.

The index measures the health of the manufacturing sector, with scores above 50 indicating growth and scores below 50 signaling a decline.

Timothy Fiore, head of the Institute for Supply Management, explained that companies are struggling with low demand and are hesitant to invest in new equipment and stock due to current federal policies and economic conditions.

-

10-Year Treasury Yield Drops Below 4% for First Time in Months

On Thursday, the yield on the 10-year Treasury bond fell below 4% for the first time since February, settling at about 3.98%. This drop came after Federal Reserve Chair Jerome Powell hinted that a rate cut could be a possibility in September. The lower yield reflects changing expectations among investors about future interest rate adjustments and the overall economic outlook.

-

Stocks Drop as Economic Data Shows Signs of Slowing

Stocks fell on Thursday after initially rising earlier in the day. The 10-year Treasury yield dropped below 4% for the first time since February, contributing to the downturn. The S&P 500 fell by 0.7%, the Nasdaq Composite dropped about 0.9%, and the Dow Jones Industrial Average declined by 0.9%.

The decline in stock prices came amid disappointing economic data. The ISM manufacturing PMI for July fell to 46.8, signaling a stronger contraction in the manufacturing sector than expected. In addition, weekly jobless claims were higher than anticipated, suggesting a slowing labor market.

This drop follows a strong rally on Wednesday, driven by comments from Federal Reserve Chair Jerome Powell, who suggested that a rate cut could be on the horizon for September. The weaker economic indicators and shifting expectations for future monetary policy contributed to the market's decline.

-

Semiconductor Stocks Decline as Nasdaq Falls 1%

On Thursday, semiconductor stocks dropped as the Nasdaq index fell by 1%, wiping out earlier gains.

Nvidia (NVDA), a major player in AI technology, saw its stock fall over 2% after a big increase the day before. Other semiconductor companies like Broadcom (AVGO) and ASML (ASML) also experienced significant losses, with their shares dropping more than 4%.

This decline follows a strong performance in the sector on Wednesday. AMD (AMD) reported better-than-expected results, and Microsoft (MSFT) announced increased spending on data center technology. Despite this, semiconductor stocks did not maintain their upward momentum and fell on Thursday.