Stocks Take a Hit as Bond Yields Surge Amid Strong Jobs Data: Stock Market Update Today

Wall Street Faces Sell-Off Amidst Rising Treasury Yields and Fed's Hawkish Stance.

A significant sell-off rattled Wall Street on Tuesday, driven by a surge in Treasury yields that cast uncertainty on the possibility of an immediate interest rate cut by the Federal Reserve.

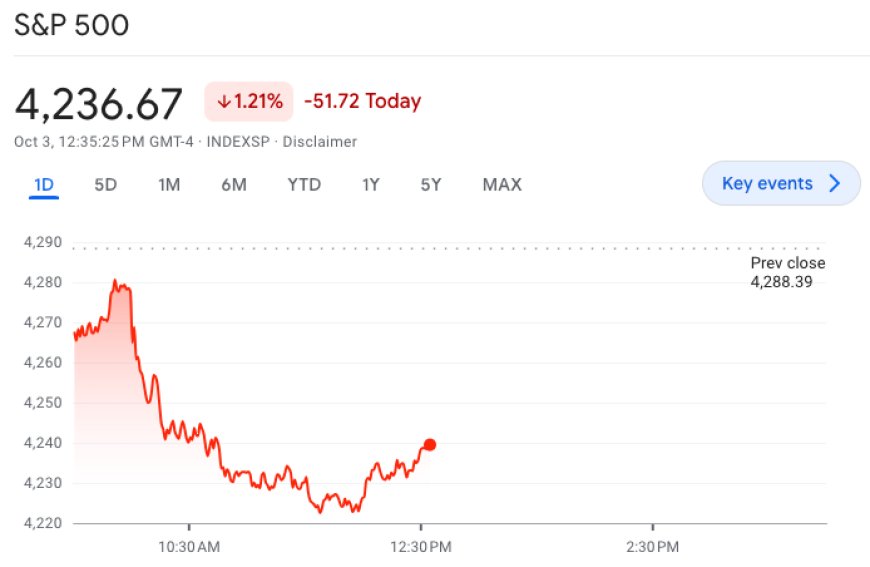

The S&P 500 (^GSPC) experienced a drop of nearly 1.1%, while the Dow Jones Industrial Average (^DJI) tumbled about 1.1%, equivalent to over 350 points. The tech-oriented Nasdaq Composite (^IXIC) also suffered a decline of over 1.5%, following a positive close on Monday.

Remarks from Federal Reserve officials indicated that the strength of the US economy is likely to maintain elevated borrowing costs for an extended period. According to the CME's FedWatch tool, traders are currently assigning a 29% probability that policymakers will raise rates at their November meeting, compared to just 16% a week ago.

This outlook led to a surge in 10-year (^TNX) and 30-year Treasury yields (^TYX), reaching 16-year highs on Tuesday. This bond sell-off, combined with spikes in oil prices and the value of the dollar, has diminished appetite for stocks. The Russell 2000 index of small-cap stocks turned negative for the year on Monday.

In other economic news, the number of job openings in the US increased in August, raising questions about whether the job market is cooling rapidly enough to satisfy the Federal Reserve. The latest Job Opening and Labor Turnover Survey (JOLTS) report, released on Tuesday, revealed there were 9.6 million job openings at the end of August, up from 8.83 million in July. Economists surveyed by Bloomberg had anticipated 8.82 million openings in July.

The JOLTS report precedes the highly anticipated September US jobs report scheduled for release on Friday.

Stocks Slide on Hawkish Fed Comments

Stocks faced further downward pressure after Cleveland Fed President Loretta Mester stated on Tuesday that she is likely to support a rate hike at the next meeting if the current economic conditions persist.

The Dow Jones Industrial Average (^DJI) plummeted by more than 400 points, or 1.26%, while the S&P 500 (^GSPC) sank by 1.5%. The tech-heavy Nasdaq Composite (^IXIC) experienced a drop of 1.8%. Mester emphasized that the Federal Reserve is likely at or near its peak interest rate target and anticipates achieving 2% inflation by the end of 2025.

Stocks Making Headlines in Morning Trading

-

Plug Power (PLUG): Shares dipped by 5% after Truist Financial lowered its price target on the stock to $8 per share from the previous $9. Concerns over prolonged higher interest rates also contributed to the decline, particularly impacting energy-related stocks.

-

Gamestop (GME): The meme-favorite stock experienced another 4.5% drop in early trading, hitting its lowest level since February 2021, following the appointment of Ryan Cohen as CEO last week.

-

McCormick (MKC): Shares were down nearly 9% after the company reported a year-over-year decrease in quarterly profit. The stock is heading for its lowest close since March 2020.

-

Point Biopharma (PNT): Shares surged by over 85% on the news of Eli Lilly's acquisition of the company for $1.4 billion, as announced on Tuesday. However, shares of Eli Lilly (LLY) fell by 3.5%.

Also Read: U.S. Futures Stabilize as Shutdown Threat Eases; China's Growth Forecast in Focus