Stock Market Live Update: US Futures Dip After Micron's Forecast, Key Economic Data in Focus

US stock futures fall after Micron's cautious forecast. Investors await key economic data and inflation reports that could influence Federal Reserve decisions.

US stock futures fell on Thursday after chipmaker Micron (MU) released a cautious sales forecast. Investors are also waiting for important economic reports that could influence Federal Reserve decisions.

Key Indices Drop

-

S&P 500 futures (ES=F) fell about 0.2%, after nearing a record high on Wednesday.

-

Dow Jones Industrial Average futures (YM=F) and Nasdaq 100 futures (NQ=F) also declined by 0.2%.

Micron's Impact Micron's sales outlook for the current quarter met expectations but didn't exceed them, disappointing investors hoping for outstanding performance from AI-related companies. This added to concerns that the tech-driven rally, which has boosted the S&P 500 by 15% this year, could slow down if these companies don't continue to perform exceptionally.

Market Reactions

-

Micron's shares dropped nearly 6% in pre-market trading.

-

Nvidia (NVDA) shares fell by 1.6%, raising fears of another sell-off like the one seen last week. Other AI chip stocks were also under pressure.

Economic Data Focus Investors are closely watching updates on GDP and weekly jobless claims before the market opens. These will be followed by the PCE inflation report on Friday, which is important for the Fed's decision-making on interest rates. A rise in unemployment claims would increase worries about a weakening job market.

Political and Corporate News

-

Inflation is expected to be a major topic in the debate between President Joe Biden and former President Donald Trump on Thursday night.

-

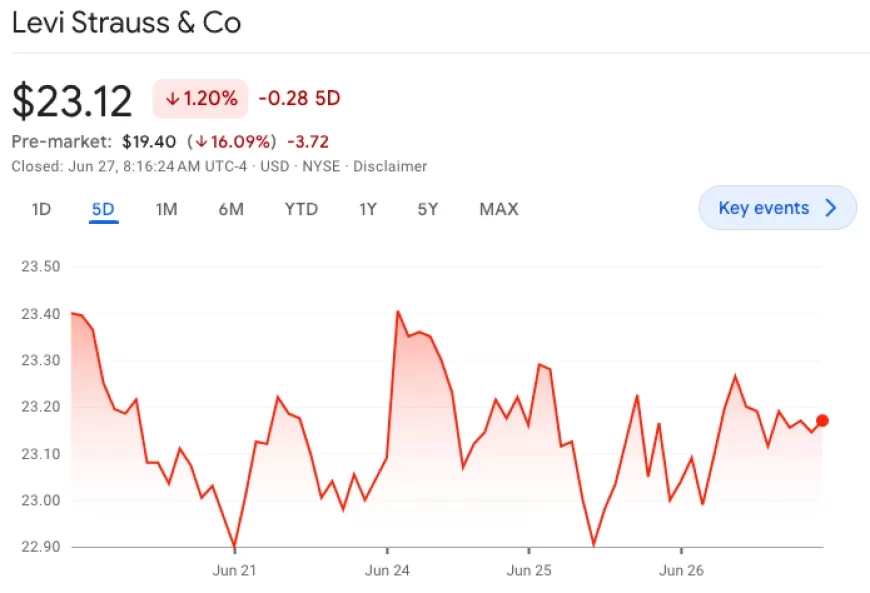

Levi Strauss (LEVI) shares plunged over 15% after missing second-quarter revenue expectations.

-

Nike (NKE) will report its quarterly results after the market closes, providing more insights into consumer spending.

This market update shows a mix of caution and anticipation as investors react to corporate earnings, economic data, and political events.

Also Read: Rivian Stock Surges After Major Deal with Volkswagen

-

Why Levi's Quarterly Earnings Are Concerning

Levi's (LEVI) shares have dropped 15% in pre-market trading after their latest earnings report, and this decline seems justified for two main reasons.

First, Levi's sales in China have fallen by 10% compared to last year. Recent feedback from visitors to China suggests that Chinese consumers are currently spending less due to economic concerns. This reduced spending is affecting the demand for Levi's jeans, Starbucks (SBUX) coffee, and Haagen Dazs ice cream, as indicated in General Mills' (GIS) earnings report. It's unclear when the situation in China will improve.

Second, Levi's wholesale business, which sells to department stores, saw a 4% decline in sales from the previous year. The company does not anticipate a recovery in wholesale demand until 2025.

These challenges highlight significant issues for Levi's, both in terms of international sales and domestic wholesale operations.

-

Stock markets began Thursday with slight declines as investors assessed new economic data

The S&P 500 (^GSPC) showed minimal movement, while the Dow Jones Industrial Average (^DJI) slipped 0.1%. The Nasdaq Composite (^IXIC), heavily influenced by technology stocks, remained just below unchanged.

In economic updates, the Bureau of Economic Development reported that real gross domestic product (GDP) grew by 1.4% annually in the first quarter of 2024. This figure, released Thursday morning, was slightly higher than the previous estimate of 1.3%, though it marked the slowest growth since 2022.

Meanwhile, the Department of Labor announced that initial weekly jobless claims fell to 233,000, a decrease of 6,000 from the previous week.

On the corporate side, Micron Technology (MU) met sales expectations for the current quarter but disappointed investors looking for stronger performance from AI-focused companies. Micron's stock dropped approximately 4% in early trading. Nvidia (NVDA), another major player in AI chips, also saw a decline of nearly 1% at the market open.

-

Netflix and Meta Propel Nasdaq Higher Amid Tech Stock Surge

Communication stocks led by Netflix (NFLX) and Meta (META) boosted the Nasdaq Composite (^IXIC) into positive territory on Thursday morning, with the index rising by 0.3% shortly after the market opened.

Investors saw gains in both Netflix and Meta, each climbing over 1%, which contributed significantly to the tech-heavy index's rebound after initially hovering just below the flatline.

Meanwhile, the broader market showed mixed movements, with the S&P 500 (^GSPC) gaining 0.2% while the Dow Jones Industrial Average (^DJI) remained relatively unchanged.

Chip giant Nvidia (NVDA), however, experienced slight declines following Micron’s (MU) sales forecast, which failed to meet expectations amid ongoing market enthusiasm for AI technologies that have driven much of this year's rally.

-

Walgreens Faces 24% Stock Drop Due to Challenging Pharmacy Trends and Weak Consumer Demand

Walgreens Boots Alliance witnessed a sharp 24% decline in its stock, marking its lowest level since 1997, after revising down its fiscal 2024 earnings guidance. The company pointed to "challenging pharmacy industry trends" and a "weaker-than-expected US consumer environment" as reasons for the adjustment.

CEO Tim Wentworth explained during Thursday morning's earnings call that customers have become more selective and price-sensitive in their purchases.

In response to these challenges, Walgreens plans significant changes, including the closure of a large number of underperforming stores over the next three years. Approximately 25% of its current stores do not align with the company's long-term strategy.

The revised earnings forecast now anticipates adjusted earnings per share for the fiscal year to range between $2.80 and $2.95, down from the previous estimate of $3.20 to $3.35.

-

Retirement Savings Crisis Looms for 55-Year-Old Americans

Fifty-five-year-old Americans face a looming retirement savings crisis, with a median savings of less than $50,000. This falls far short of the recommended target of saving eight times their annual income by retirement age.

David Blanchett, head of retirement research at PGIM DC Solutions, highlighted the implications of inadequate savings: "A lot of folks are behind, and that has important longer-term implications for retirement."

The financial challenges extend beyond the future; many 55-year-olds are struggling presently. A survey by Prudential Financial revealed that more than one-third of this age group would find it difficult to cover a $400 emergency expense, underscoring immediate financial strain.

As retirement approaches, the gap between savings and financial needs poses significant concerns for older Gen Xers, highlighting the need for urgent financial planning and savings strategies.