US Stock Market Live Updates: US Futures Gain as Key Inflation Data Shows Continued Cooling

S&P 500 and Nasdaq Futures Show Gains as Inflation Eases

On Friday, US stock futures climbed, driven by encouraging inflation data and reactions to the recent Biden-Trump debate.

S&P 500 futures (ES=F) increased by approximately 0.3%, moving closer to their record high. Futures for the tech-focused Nasdaq 100 (NQ=F) rose by 0.4%, while Dow Jones Industrial Average futures (YM=F) remained slightly above flat. These indices are on track for a positive end to a volatile week, which saw the S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) recover from a three-day losing streak. Although stocks have had a strong first half of the year, there are concerns about potential declines in the second half.

The latest reading of the Fed's preferred inflation gauge provided significant data for the first half of the year. The report showed that inflation slowed in May, with prices increasing at their slowest rate since March 2021. The core Personal Consumption Expenditures (PCE) index, which excludes food and energy costs and is closely monitored by the Fed, rose by 0.1% in May compared to the previous month, meeting Wall Street's expectations.

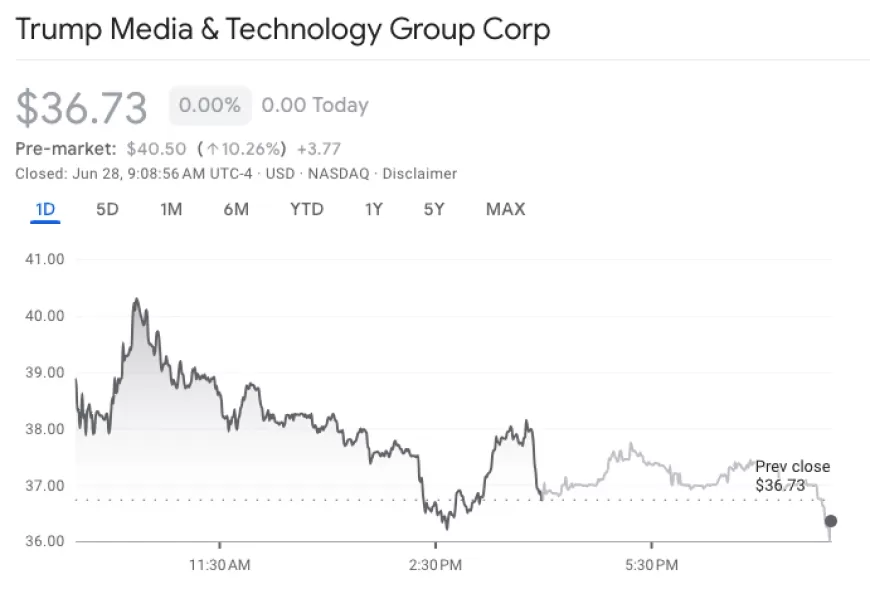

In addition to economic data, investors are also focusing on political developments ahead of the November US election. President Joe Biden's performance in his first debate with likely Republican nominee Donald Trump was seen as weak. Trump's proposals for tax cuts and stricter trade policies are expected to boost stock markets. Shares of Trump Media & Technology Group (DJT) surged in pre-market trading.

The market is also vigilant for signs of weakening consumer spending, as some major companies have issued pessimistic sales forecasts. Nike (NKE) saw its stock drop nearly 15% in pre-market trading, while Walgreens (WBA) shares continued to face pressure following a 22% decline on Thursday.

By keeping an eye on these developments, investors hope to navigate the market's ups and downs more effectively as they move into the latter half of the year.

Also Read: US Futures Dip After Micron's Forecast, Key Economic Data in Focus

Key Moments

- US stock futures rise on cooling inflation data.

- S&P 500 and Nasdaq 100 futures show notable gains.

- Fed's core PCE index reports slowest price increase since March 2021.

- Political developments from Biden-Trump debate influence market sentiment.

-

Nike Shares Drop Amid Disappointing Guidance and Management Concerns

Nike's stock is taking a hit, dropping 14% in pre-market trading. The company's latest guidance fell short of expectations, raising concerns about its management's ability to innovate its product lineup. Given it's an Olympic year, the lack of stronger guidance is particularly troubling.

-

Trump Media & Technology Sees Surge After Biden's Debate Performance

Shares of Trump Media & Technology (DJT) surged 7.5% in pre-market trading following President Joe Biden's debated performance.

Investors should exercise caution when considering trades.

Review the company's latest 10-Q report for insights into its operations and financial performance.

-

Federal Reserve's Core Inflation Measure Indicates Slowest Rise Since March 2021

The most recent data from the Federal Reserve's preferred inflation gauge shows a slowdown in May, marking the smallest increase since March 2021.

In May, the core Personal Consumption Expenditures (PCE) index, which excludes food and energy costs and is closely monitored by the Federal Reserve, grew by 0.1% compared to the previous month. This matches the expectations of financial analysts and indicates a decline from the 0.3% rise seen in April.

On an annual basis, the core PCE index increased by 2.6% in May, consistent with forecasts and unchanged from the figures reported in the previous two months. This annual rise represents the slowest inflationary growth observed in more than three years.

-

Market Optimism as Fed's Preferred Inflation Measure Shows Decline

U.S. stocks saw gains on Friday as the Federal Reserve's preferred inflation gauge indicated a continued easing of inflation, heightening speculation of future interest rate cuts.

The S&P 500 (^GSPC) edged up about 0.1%, nearing its record high. The tech-heavy Nasdaq Composite (^IXIC) rose by 0.3%, while the Dow Jones Industrial Average (^DJI) saw a modest increase of around 0.1%.

-

Market Updates: Noteworthy Stocks in Morning Trading

In morning trading today, several stocks are making headlines:

Trump Media & Technology Group (DJT): Shares of Trump Media & Technology Group saw volatility following the first 2024 presidential debate between Donald Trump and Joe Biden. Biden's performance was perceived as uncertain compared to Trump's, briefly boosting the stock before settling down.

Nike (NKE): Nike's stock plummeted nearly 20% after the company projected a significant sales decline for 2025, particularly in the first quarter.

Infinera (INFN): Infinera, a telecommunications equipment maker, surged 17% after announcing an acquisition deal by Nokia for $2.3 billion, offering a 28% premium over its recent closing price.

Chewy (CHWY): Chewy, an online pet food supplier, experienced a volatile morning, with its stock dropping close to 10%. The instability followed unusual trading activity prompted by external influences.

These developments underscore the dynamic nature of stock trading, influenced by corporate performance and market sentiment.