“You Don’t Need Bitcoin” — Saylor’s Biggest Crypto U-Turn Yet

Bitcoin bull Michael Saylor shocks investors with unexpected comment—“You don’t need Bitcoin.” Is he backing out? Here's what’s really going on.

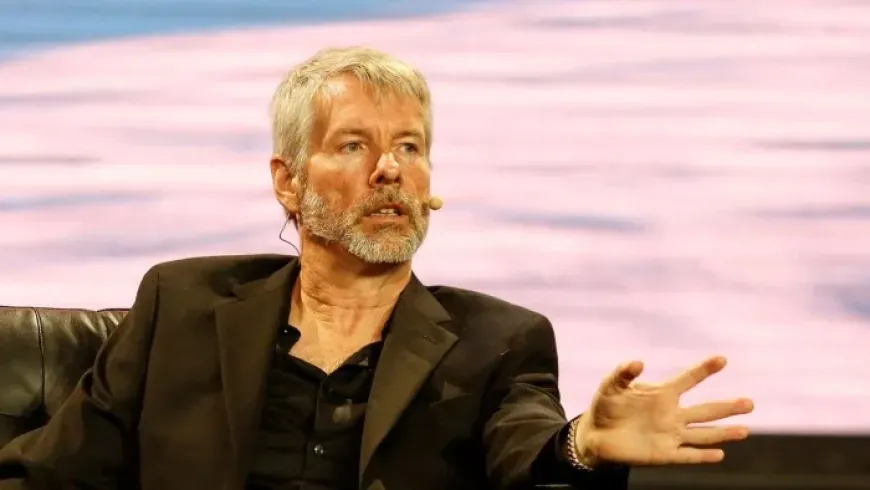

Michael Saylor, the co-founder and executive chairman of MicroStrategy (Nasdaq: MSTR), has long been one of the most vocal Bitcoin advocates in corporate America. But his latest comments have sparked confusion and conversation across the crypto world.

In a surprising post on X (formerly Twitter) on June 12, Saylor wrote, "If you have everything—you don’t need Bitcoin." The remark caught many off guard, considering his history of urging governments, corporations, and individuals to invest in Bitcoin as a safeguard against inflation and fiat instability.

If you have everything—you don’t need Bitcoin. — Michael Saylor (@saylor) June 12, 2025

Under Saylor’s leadership, MicroStrategy began accumulating Bitcoin in 2020, at the height of the COVID-19 pandemic. Today, the company holds a staggering 582,000 BTC — worth approximately $62.3 billion — making it the largest public corporate holder of Bitcoin. The only notable competitor is Elon Musk’s Tesla (Nasdaq: TSLA), which holds 11,509 BTC valued around $1.2 billion.

Saylor’s remark stirred a range of reactions online. Crypto portfolio platform CoinStats cheekily replied, "If you have Bitcoin—you already have everything." Another user, @dscompounding, noted, "If you have everything, Bitcoin is your hedge against losing it all."

"If you have Bitcoin—you already have everything." pic.twitter.com/IcWmThNExd — CoinStats (@CoinStats) June 12, 2025

While some took the comment at face value, others saw it as a more nuanced message. Saylor may be suggesting that only those with total financial security could afford not to consider Bitcoin — a notion that raises broader questions about wealth protection, inflation, and financial inclusion.

did you just challenge retail to stay poor? ???????? pic.twitter.com/BmkPRA96Zy — BREAD ???? (@tradewithbread) June 12, 2025

Despite the stir, it’s unlikely Saylor has abandoned his core beliefs. He has previously forecasted that Bitcoin could reach $13 million by 2045, and his firm's growing BTC holdings suggest continued conviction in the digital asset.

For Bitcoin maximalists, Bitcoin remains more than just an investment — it's seen as a financial shield in an increasingly unstable economic world. As of press time, Bitcoin was trading at $106,845.40, according to Kraken — up over 1,100% in the last five years.

Whether Saylor’s statement signals a true shift in stance or simply a philosophical musing, it has reignited debate on who truly "needs" Bitcoin — and who can afford not to.

Also Read: BlackRock Bitcoin ETF Could Surge 12,400% by 2045, Says Billionaire Michael Saylor