Stock Market News Update: Stock Markets Rise in the Final Days of 2023

Positive stock market trends as 2023 concludes. Insights and forecasts for an optimistic start to 2024

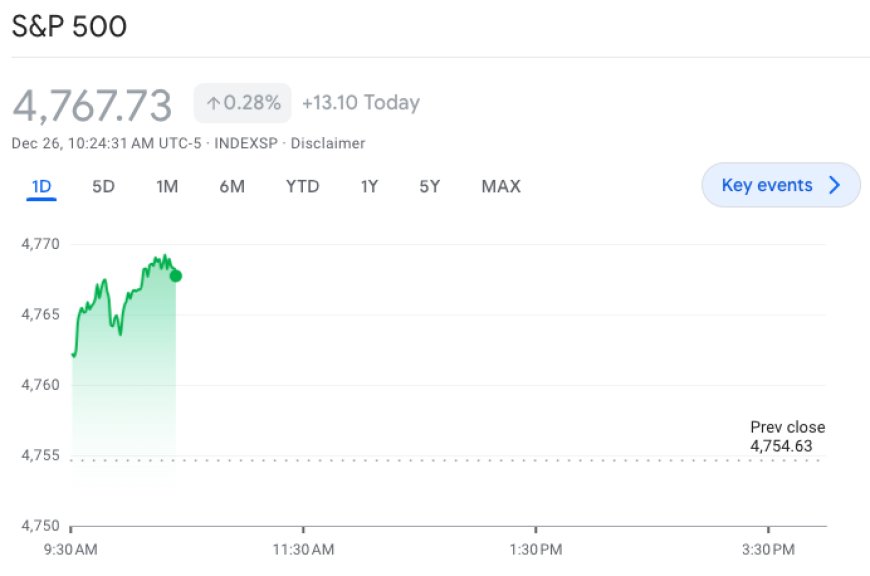

In the final trading session of 2023, stock markets witnessed a positive surge on Tuesday morning, riding on the momentum of a year-end rally. Optimism about a soft landing is gaining strength, with more positive outlooks for 2024 taking hold.

During morning trading, the Dow Jones Industrial Average (^DJI) inched just above the flatline. The benchmark S&P 500 (^GSPC) experienced a modest gain of 0.1%, while the tech-heavy Nasdaq Composite (^IXIC) advanced by 0.3%.

All three major indexes closed the year with double-digit gains, with the Nasdaq leading the way with impressive year-to-date gains of over 40%.

The surge in stocks coincides with expectations on Wall Street that the Federal Reserve will soon conclude its tightening campaign. This is seen as a significant signal that the central bank's efforts against inflation have taken a positive and decisive turn.

At the start of the year, concerns were rife among market observers regarding pricing pressures and the potential negative consequences of the Fed raising interest rates. However, as the year concludes, the narrative has shifted. Discussions now revolve around the possibility of the Fed cutting rates, surprise at the cooling of inflation, and the resilience of the job market. Despite initial fears of economic slowdown, unemployment remains below 4%.

Looking ahead to 2024, new challenges are anticipated. While a recession predicted for this year may still pose a threat, Fed Chair Jerome Powell has emphasized that the timing of rate cuts is not predetermined. If the economy experiences a robust comeback, there may be further rate hikes or a delay in rate cuts in the next phase of the Fed's policy action.

Chris Zaccarelli, Chief Investment Officer for Independent Advisor Alliance, commented, "Most of 2023 has been about the resilient consumer and waiting for a recession, which never came, but we think 2024 is going to be much more about inflation going back to target in a sustainable way or inflation getting 'stuck' and forcing the Fed to cut much less than the market expects."

In corporate news, Intel (INTC) saw a 2% rise as the company confirmed securing over $3 billion in incentives from the Israeli government to expand wafer fabrication in the country.

Also Read: Stock Market Takes a Break: Wall Street Calms Down as FedEx Faces Problems