What Is a FICO Score? How It Impacts Your Credit Profile—and How You Can Improve It

Your FICO score drives loan approvals and interest rates—understand its impact on your credit and follow proven steps to improve it fast in 2025.

Millions of Americans reach life milestones each year—buying a home, financing a car, starting a business—without ever seeing the quiet, pivotal factor that can tip the odds in their favor: their FICO score. Developed in 1989, this three-digit number has become the trusted compass for banks, insurers, landlords, and even some employers. Why does it matter so much, what factors actually influence your score, and what steps can you take to maximize it—saving yourself thousands in the process? We’ve blended expert analysis, current statistics, and stories from real people to offer you the ultimate guide to FICO scores in 2025.

What Is a FICO Score?

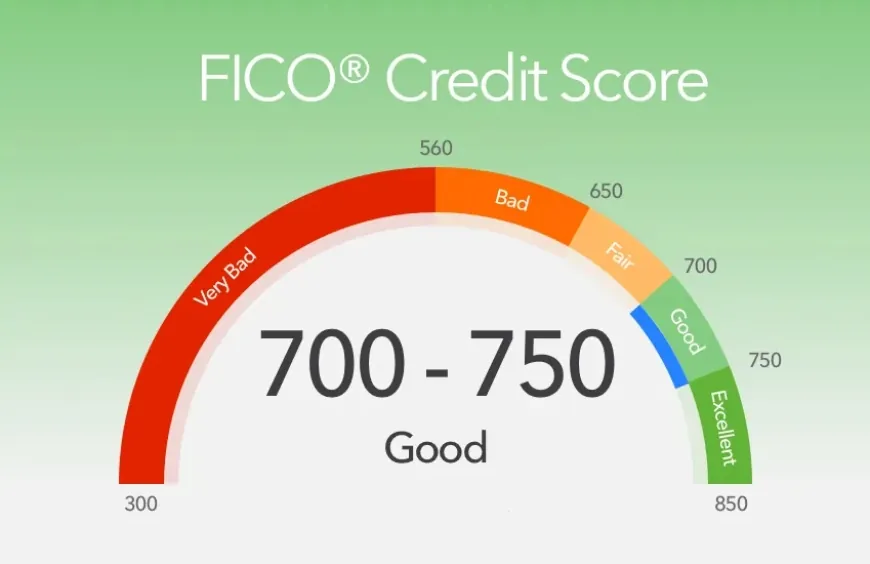

Think of your FICO score as your financial report card. It’s a three-digit number, usually between 300 and 850, that shows lenders how trustworthy you are when it comes to paying back money. This score helps decide if you’ll get approved for loans and credit cards, and what interest rates you’ll receive.

FICO, short for Fair Isaac Corporation, created this score back in 1989 and since then, it has become the most trusted credit score used by more than 90% of lenders in the United States.

Why Should You Care About Your FICO Score?

Your FICO score affects many parts of your life:

-

Mortgages and home loans: A higher score can save you thousands in interest over the life of your loan.

-

Car loans: Better scores often mean lower monthly payments.

-

Credit cards: Good scores can help you qualify for cards with rewards and low rates.

-

Renting and insurance: Some landlords and insurance companies check credit scores to decide pricing or approval.

-

Job opportunities: In some industries, employers review credit scores as part of hiring.

Simply put, your FICO score opens doors — or closes them.

How Does Your FICO Score Work?

FICO calculates your score based on five main factors:

| Factor | Weight | What It Means |

|---|---|---|

| Payment History | 35% | Do you pay bills on time? Missed payments hurt. |

| Credit Utilization | 30% | How much of your credit limit are you using? |

| Length of Credit | 15% | How long have your accounts been open? |

| New Credit | 10% | How many new accounts and inquiries do you have? |

| Credit Mix | 10% | Do you have different types of credit accounts? |

1. Payment History (35%)

The most important factor is whether you pay your bills on time. Late payments, collections, or bankruptcies can cause your score to drop quickly. Consistency matters—paying on time over months and years builds a stronger score.

Tip: Set up automatic payments or alerts so you never miss a due date.

2. Credit Utilization (30%)

This is the percentage of your available credit that you actually use. For example, if you have a $5,000 credit limit and owe $1,000, your utilization is 20%. It’s best to keep this under 30%, and even better under 10%, to show you’re not relying too heavily on borrowed money.

Tip: Pay down balances before your billing cycle ends to reduce the reported utilization.

3. Length of Credit History (15%)

The longer you’ve had credit accounts open, the better — especially if you’ve managed them responsibly. Closing old cards can shorten your credit history and hurt your score.

Tip: Keep older accounts open, even if you don’t use them often.

4. New Credit (10%)

Opening many new accounts or having multiple “hard inquiries” (when lenders check your credit) in a short time can signal risk to lenders. However, multiple mortgage or auto loan inquiries within a 30-45 day window count as just one to give you flexibility when shopping for the best rate.

Tip: Space out credit applications when possible.

5. Credit Mix (10%)

Having a healthy mix of credit types—credit cards, auto loans, mortgages—shows lenders you can responsibly handle different kinds of debt. This factor is least weighted, so don’t open accounts just for the sake of variety.

Understanding Your Score Range

| Score Range | What It Means |

|---|---|

| 800–850 | Exceptional — you’re a star borrower |

| 740–799 | Very Good — strong creditworthiness |

| 670–739 | Good — most lenders will approve you |

| 580–669 | Fair — higher interest rates likely |

| 300–579 | Poor — difficult to get credit |

Even a small change in your score can make a big difference in your borrowing costs.

Different Versions of FICO Scores

Not all FICO scores are the same. Lenders use different versions based on the loan type or the credit bureau (Experian, Equifax, or TransUnion).

-

FICO Score 8: The most common version for credit cards and personal loans.

-

FICO Score 9: Gives less weight to medical debts and ignores paid collections.

-

FICO 10 and 10T: Newer models track your payment trends over time for more precise risk assessment.

-

Industry-specific scores: For auto loans or credit cards, tailored scores focus on relevant credit behavior.

Pro Tip: Ask lenders which FICO version they use to understand how your score applies to your situation.

How to Boost Your FICO Score:

Quick (1-2 Months)

-

Become an authorized user on a family member’s credit card with good payment history and low balances.

-

Pay down credit card balances before the statement date to lower utilization.

-

Request credit limit increases without increasing your spending.

-

Dispute errors on your credit report immediately via AnnualCreditReport.com.

Long-Term Strategies

-

Pay all bills on time, every time.

-

Keep old accounts open to maintain credit history length.

-

Avoid opening too many new accounts quickly.

-

Maintain a healthy credit mix, but only open new accounts when necessary.

-

Regularly monitor your credit reports to catch errors or signs of fraud.

Common Myths About FICO Scores

-

Checking your own score hurts it? No, checking is a “soft inquiry” and doesn’t affect your score.

-

Closing unused credit cards boosts your score? Usually false; it can raise your utilization and shorten your credit history.

-

Paying off collections removes them immediately? No, they can stay on your report for up to seven years but newer models weigh paid collections less.

Why Your FICO Score Is More Important Than Ever

With rising interest rates and increased lender scrutiny, maintaining a strong FICO score saves you money and opens doors to financial opportunities. It’s your best tool to negotiate better loan terms and access credit when you need it.

Your FICO score is a living number that reflects how you manage credit over time. Understanding its components and taking consistent, responsible actions can steadily improve your financial health and free you to pursue your goals—whether it’s buying a house, driving a new car, or simply securing better credit terms.

Start today by checking your credit reports, keeping balances low, and paying your bills on time. Your future self will thank you.

Also Read: Most Americans Still Believe These Credit Score Myths—and It’s Costing Them