Surprise Job Gains in April: US Economy Adds 253,000 Jobs and Unemployment Rate Drops to 3.4%

US Job Market Continues to Thrive, Surpassing Expectations and Pushing Down Unemployment Rate to its Lowest Level in Over 50 Years

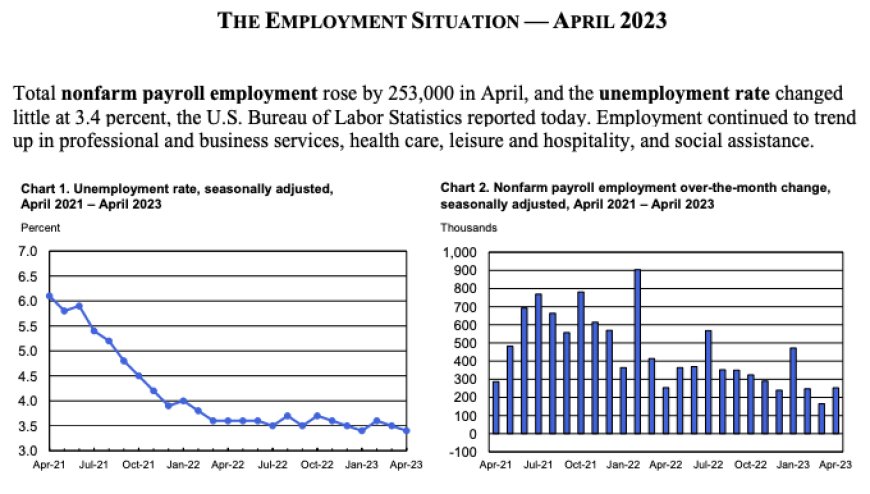

The US economy added an impressive 253,000 nonfarm payroll jobs in April, with the unemployment rate unexpectedly falling to 3.4%, the lowest level since May 1969. The report has surprised economists, who expected nonfarm payrolls to rise by 185,000 and the unemployment rate to rise to 3.6%. The report also showed strong wage growth, with wages rising 4.4% over the prior year, an acceleration from the gains seen in March. The job gains over the last six months have averaged 290,000, and the labor market remains robust, signaling a positive outlook for the US economy.

Unexpected Job Gains and Unemployment Rate Drop:

The latest job report from the US Bureau of Labor Statistics shows that the US economy added 253,000 nonfarm payroll jobs in April, surpassing expectations from economists. The unemployment rate also dropped to 3.4%, lower than the expected 3.6%. The strong performance of the labor market signals that the US economy is thriving, and the outlook is positive.

(Statics Screenshot Source: US Bureau of Labor Statistics)

Strong Wage Growth:

Wage growth remained strong in April, with wages rising 4.4% over the prior year, an acceleration from the gains seen in March. This indicates that the labor market is becoming more competitive, and employers are having to offer higher wages to attract and retain workers.

Revisions of Job Gains in March and February:

Although the job gains in April were impressive, the report revised the employment gains in March to 165,000, down from the previously reported 236,000. The February job gains were also revised lower from 326,000 to 248,000. However, job gains over the last six months have averaged 290,000, signaling a strong and consistent growth trend.

Industry and Sectoral Gains:

The largest employment gains in April were seen in the education and healthcare services, which added 77,000 workers. Business services employment rose by 41,000, while leisure and hospitality jobs increased by 31,000. Construction and manufacturing jobs rose by 15,000 and 11,000, respectively.

Positive Outlook for the US Economy:

The unexpected job gains and the drop in the unemployment rate indicate a strong labor market and a positive outlook for the US economy. Kathy Bostjancic, Nationwide chief economist, said that "the strong performance of the labor market dampens expectations of an immediate recession."

Federal Reserve's Interest Rate Hike:

The job report comes after the Federal Reserve voted to raise its benchmark interest rate by 0.25%, bringing the fed funds rate above 5% for the first time since September 2007. Fed Chair Jay Powell noted that the labor market remains "very tight," but pointed to an uptick in participation among prime age workers and moderating wage gains and a drop in job openings.

Labor Market Cooling:

Some economists believe that the job report is a sign that the labor market is cooling, and the Federal Reserve is unlikely to reconsider its plans for a pause. However, the strong performance of the labor market over the last six months indicates that the US economy is on a positive growth trajectory.

Conclusion:

The April job report is a positive sign for the US economy, with unexpected job gains, a drop in the unemployment rate, and strong wage growth. The labor market remains robust, and the outlook is positive in the US.

Read Also: May Day 2023 to see rallies and marches across Southern California in support of workers